Asset Turnover Ratio Increase Means

The companys performance is measured to the extent to which its asset inflows revenues compare with its asset outflows Net income is the result of this equation but revenue typically enjoys equal attention during a standard earnings callIf a company displays solid top-line growth analysts could view the. Equity turnover can increase either because of an increase in sales a decrease in equity or both.

Asset Turnover Ratio Formula And Calculator

As per the above example the Accounts Receivable Turnover Ratio in days for Ace Paper Mills would be 365566 times.

. Accounts Receivable Turnover in year 1 was 285 days. Total Asset Turnover Revenue Average Total Assets Fixed Asset Turnover. B Current assets Current liabilities.

A current ratio of less than one means. The fixed asset turnover ratio reveals how efficient a company is at generating sales from its existing fixed assets. In year 2 this ratio increased indicating that the company needed 303 days to collect its receivables.

Interpretation of the Ratio. The higher the turnover the shorter the period between purchases and payment. That is 6448 Days.

Higher the value means fund has been able to give better returns for the amount of risk. Interest coverage ratio falls under the group of. An increase in stock turnover ratio indicates that business is becoming more efficient.

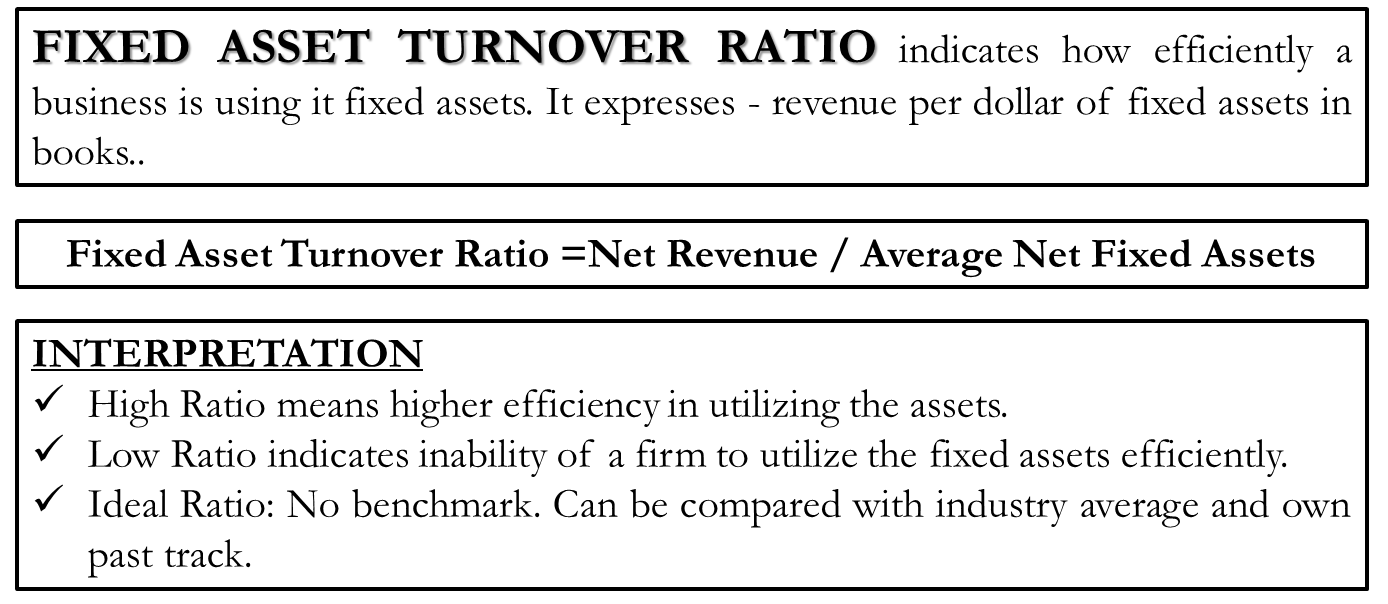

Turnover ratios that are used widely are inventory turnover ratio asset turnover ratio sales turnover accounts receivable and accounts payable ratio. It means that the company was able to collect its receivables averagely in 285 days that year. A higher ratio implies that management is using its fixed assets more effectively.

The receivables turnover ratio is an absolute figure normally between 2 to 6. Turnover is the income that a firm generates through trading goods and services. 1 Evaluating Home Depots Increase in Sales Home Depot Sales increased its revenue from 7042billion to 8852 an increase of approximately 25 in 4 years.

An asset is a resource with economic value that an individual corporation or country owns or controls with the expectation that it will provide future benefit. Assets are reported on a. Revenue is a crucial part of financial statement analysis.

An asset turnover ratio measures the efficiency of a companys use of its assets to generate revenue. The working capital ratio is important to creditors because it shows the liquidity of the company. A Current assets Current liabilities.

The meaning is quite clear. A high AR turnover ratio is usually desirable but not if credit policies are too restrictive and. Accordingly Accounts Receivable Turnover in days is calculated using the following formula.

Compare your days in accounts payable to supplier terms of repayment. Treynors Ratio Treynors ratio indicates how much excess return was generated for each unit of risk taken. The accounts receivables ratio on the other hand measures a companys efficiency in collecting money owed to it by customers.

Current liabilities are best paid with current assets like cash cash equivalents and. Accounts Receivable Turnover Days Year 2 325 3854 360 303. A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6.

What is Working Capital. Revenue is the total value of goods or services sold by the business. Accounts Receivable Turnover in days 365Receivable Turnover Ratio.

Total asset to debt ratio. You can also use our Receivable Turnover Ratio Calculator. D All of the above.

The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets. A low turnover may be a sign of cash flow problems. A high turnover may indicate unfavourable supplier repayment terms.

Fixed Asset Turnover Definition Formula Interpretation Analysis

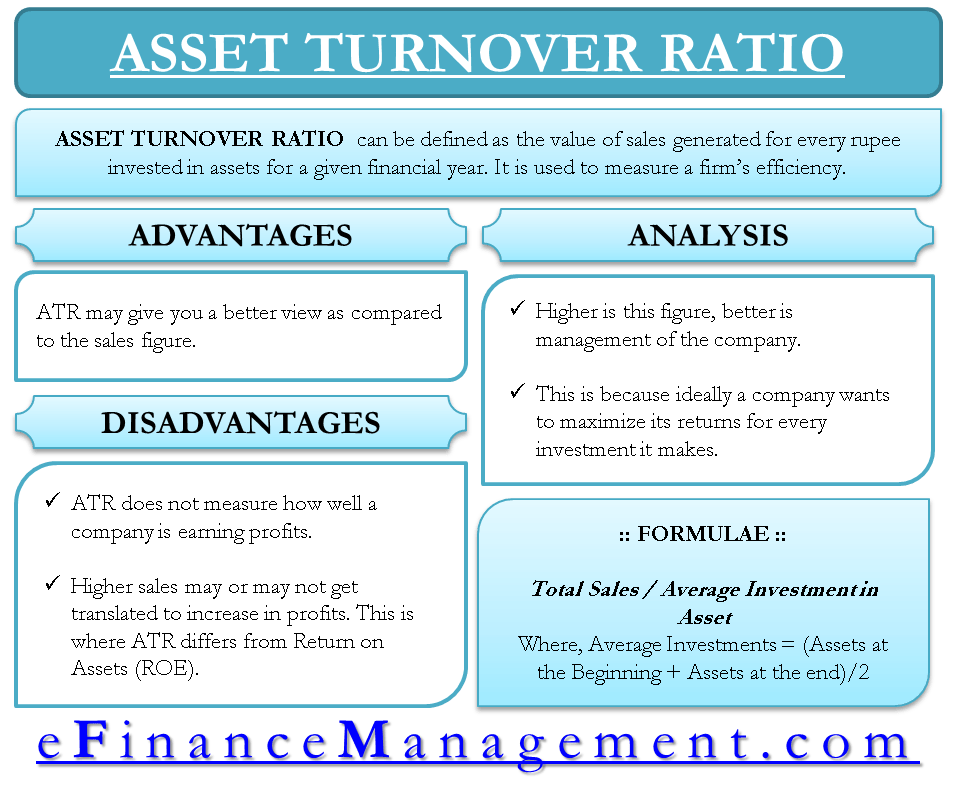

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Asset Turnover Ratio Formula Meaning Example And Interpretation

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Asset Turnover Ratio Formula And Calculator

0 Response to "Asset Turnover Ratio Increase Means"

Post a Comment